U.S. Certifications Modernization Project

Partnering with the IRS on an end-to-end, human-centered design-forward approach to the taxpaying process.

The challenge

Every year, the IRS receives about 400,000 Applications for U.S. Residency Certification (Form 8802), which is used to request a certificate of residency (Form 6166) that U.S. residents may need to claim income tax treaty benefits and other tax benefits in foreign countries.

Currently, 70% of Form 8802 submissions are submitted through the mail and processed manually, and nothing is processed digitally. The process is rife with complications. Taxpayers fill out forms incorrectly and without real-time error prevention, so they submit incomplete or inaccurate forms that need to be corrected in a back-and-forth fashion with an IRS employee. Forms are submitted without proper payment. Form processing speed is slow, which is frustrating to taxpayers.

How could this process become more efficient for both taxpayers and the IRS? Coa Solutions partnered with the U.S. Residency Certification team (U.S. Certs) to develop a comprehensive, end-to-end modernization of the processing of Form 8802.

Role

I was the senior UX designer on this project, working under the design director and alongside 2 engineers, a project manager, and our CEO.

Timeline

1 year; contract terminated unexpectedly due to extenuating political factors at around 4 months.

Tools

Figma, Lucidchart, pen & paper

Working at the IRS

Working on a project that aims to fundamentally change a significant process at one of the largest federal agencies is no simple task. There are many different protocols and practices to follow to remain in compliance with IRS standards for development and deployment of work. There are security boundaries and approved software products and tools, so any recommendations to achieve a better solution must be approved by the IRS Product Owner and IT department. There are numerous stakeholders, both inside and outside of the IRS, whose opinions and approval are required for work to move forward.

So the most important ingredient for success on a project like this is trust building and working at the pace of the client.

Project goals and key tasks

Although Form 8802 and its related forms are small-scale in terms of numbers of forms processed annually, auditing the process from a technological perspective revealed how complex it is.

Our design and engineering goals can be broken into 2 parts, based on mode of form completion: digital and print.

Digital:

To design, build, and deploy an online platform for taxpayers to fill out and submit Form 8802, attach documents digitally, and submit payment online.

Have any and all online form(s) seamlessly work with Pay.gov for user authentication and payment to process online submission.

Retrofit the U.S. Certs EFS system to be compatible with and automatically import information that taxpayers submit digitally (both application and payment data) to the U.S. Certs system (namely, the U.S. Certs Electronic File Storage (EFS) Pegasystems (Pega) cloud-based application).

Print:

Pilot the capability to scan U.S. Certs paper mail—something that hasn’t been done before. We’d identify and leverage any existing IRS scanning capability (including equipment and staffing) to scan the images into the EFS Pega application to combine inventory sources, with the goal of maintaining first in, first out, processing goals.

Technological requirements: research steps required to integrate a scanner for digitizing paper forms and preparing the data for putting into Pega; identify data fields captured from scanned forms; define workflow steps for data validation, error handling, and storage in Pega.

Current state of Form 8802 processing

The IRS receives about 400,000 applications for U.S. residency certification (Form 8802) per year. In the last year, 80,000 forms were sent in by fax and 144,000 by paper—meaning all of the form processing is done non-digitally. This is a lot of paper to process, and while faxed forms go into an existing workflow, paper forms have a lengthy process that few people are trained on and it takes a long time to process each form and its corresponding payment(s).

This diagram represents the current state of form processing at the IRS. The majority of taxpayers are businesses—this includes anyone who is not an individual (trusts, estates, nonprofit entities, etc.) at around 65%, and the majority of forms are filed by paper mail (around 70%). The remainder are filed by e-fax.

Mail processing is fairly straightforward. Forms and checks come via the mail and are processed in an office and entered manually. E-fax forms are entered into EFS, which turns the data into a PDF, then creates an 8802 form within the Pega workflow.

Reimagining the process

The IRS is over 160 years old—processes and protocols are well-established, so shifting culture, even at seemingly minuscule levels, can be a herculean effort. It requires a highly nuanced understanding of all stakeholders, the culture of the organization, and the ability to build trust with everyone involved.

These sketches diagrams reflect the conversations, research, and listening that went into reimagining what the Form 8802 completion and processing could look like from both the taxpayer and processor perspective.

The first sketch I made on my first day on the project—trying to piece together all the components at play with Form 8802—from individual and business taxpayers to the different IRS portals involved in filing tax forms, to the breakdown percentage-wise of how forms are filed and who is filing forms, to how processes *could* take place in a potential future state.

A cleaned-up version of my pen-and-paper diagram to show our stakeholders. This shows how individuals and businesses could file Form 8802 online using existing IRS digital infrastructure—either IOLA or BOLA (Individual Online Account or Business Online Account), which would redirect them to pay their fee using Pay.gov (another existing infrastructure), and the corresponding backend infrastructure of how that data would get stored. If taxpayers chose to continue filing by mail, which the majority of taxpayers do currently, this diagram shows how an updated process would make things more efficient for form processors at the IRS—a scanning process and how that data would be stored digitally, similar to how it would be stored digitally if forms were submitted digitally.

A slight update on the previous diagram to simplify the visualization of both the digital and print future state for the U.S. Certs team. This version of the diagram breaks out IOLA and BOLA more clearly and removes extraneous information.

This version is the most simplified version that shows all parts of the future state process: individual and business taxpayers and the digital and print solution. It isn’t the most detailed, but it shows the most birds-eye overview and is the easiest way to show the broadest group of stakeholders what this project is all about.

A version of the diagram that only shows the digital solution—not the print/scanning solution. This allowed the team to just focus on this, since we were facing challenges with staffing capacity for scanning.

User journeys

Things move slowly at the IRS, and understandably so. Making our case for why was very important—design whys, engineering whys—and user journeys were an important tool for explaining our design thinking to rooms full of non-designers.

I made this hybrid user journey diagram to give context to the diagrams mentioned earlier—almost like walking someone through the process if they were completely unfamiliar or just learning about it for the first time. It highlights the points throughout the future state diagram where the user will ideally experience the opposite of a pain point. These sentiments in the blue boxes served as the guiding light for if we were moving in the right direction with our design, and these were informed by conversations we had with U.S. Certs SMEs.

Depending on the stakeholder group we were presenting to, we swapped out the graphic we used to either present more or less information. This is just a simpler graphic with the same user journey information.

Prototype development

Creating a clickable prototype for taxpayers to file Form 8802 online was a primary digital deliverable.

The digital solution needed to meet the following requirements:

Have functionality for business users and partnerships to submit the form—something currently not possible in the DMAF (digital mobile-friendly form) solution

Have a payment page (partial payments, complete payments, payments for multiple people) in ACH credit and debit, plastic cards and digital wallets

[Future] Connect to Pega EFS and Pay.gov

Since we didn’t complete this project, some outstanding issues we didn’t resolve:

Understanding the requirements for digital signature for both business and individual users—Form 8802 submission may have a legal requirement for a digital signature for perjury statement(s) and potentially form submission itself, and there may be difference depending on type of form submission (individual or business) and number of users on the submission (one or multiple).

This is a live, earlier version of the prototype. It does not feature the most up to date designs, as the contract was terminated early.

Above: the progression of wireframe development for Form 8802.

The following screens highlight the most significant improvements that digitizing the form made from the current/existing process.

The instruction page. When users search for Form 8802 and find the PDF form on IRS.gov today, there are 2 PDFs: the instructions for the form, and the form itself. This instruction page intends to give taxpayers important information from the PDF upfront, and the digital form itself also has instructions embedded throughout. Users can also revisit these instructions while filling out the form by clicking on the side navigation and not lose their place in the form.

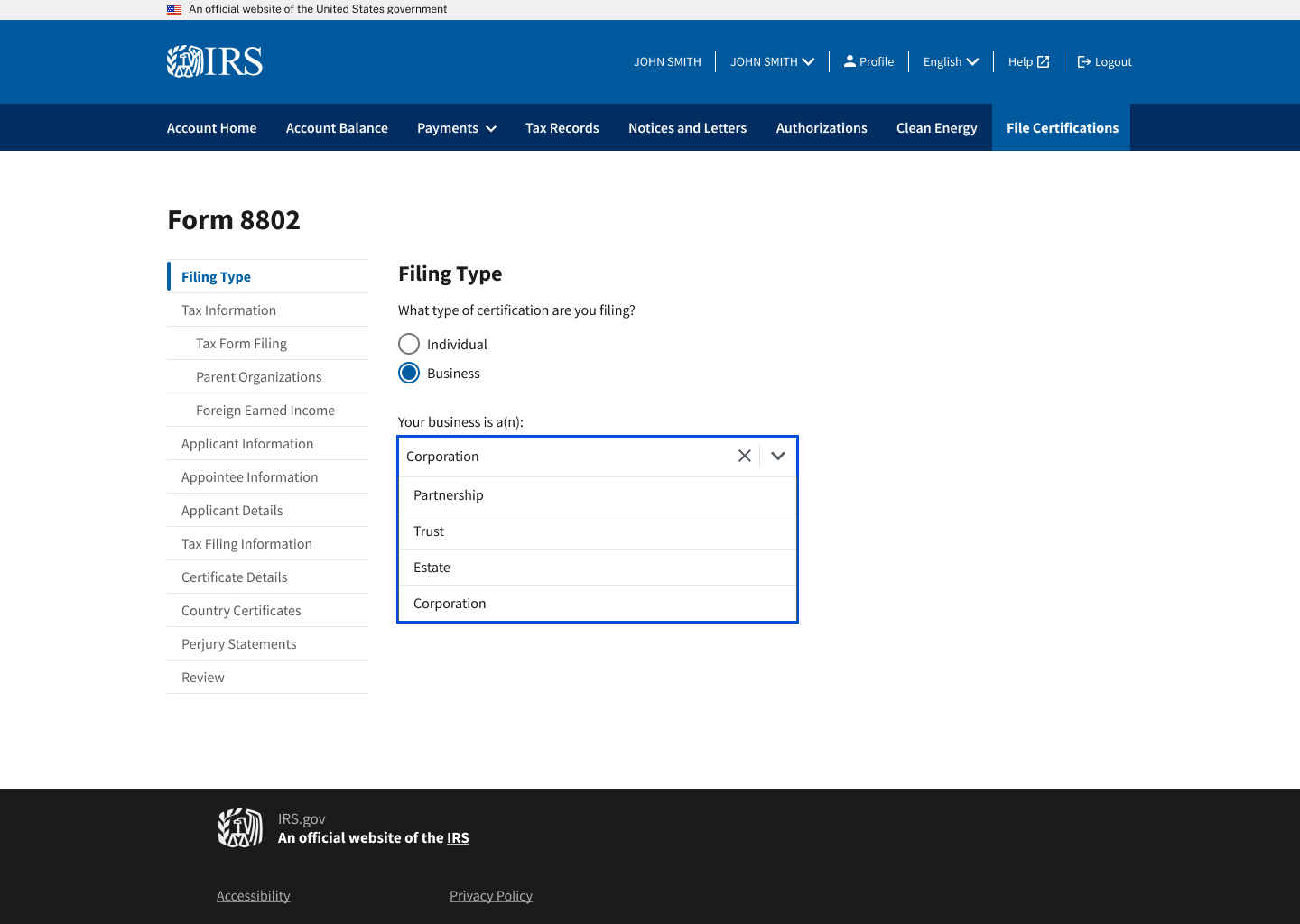

Filing type

The first step in this flow is selecting if you are an individual or a business filer. This will change what type of form you fill out, but it is all the same entry point into the form. The business filing options are obviously more varied, and upon selecting this choice, filers are prompted to selected what type of business they are.

Depending on the organization sub-type, form fields related only to those specific sub-types are shown. This is something that can’t be done on the physical Form 8802, where all options are visible, which can be confusing to filers. By presenting only the applicable options, it simplifies what filers need to do and minimizes the possibility of errors.

Tax form filing

When you read Form 8802, the tax form question appears later in the form than where we placed it in the flow. We decided to move it up because the SMEs we spoke with at U.S. Certs mentioned that for many filing types, especially businesses (who are the majority of the filings), a tax form is both required and missing from the filings they process. This means they need to follow up with filers to hunt down missing documentation, which adds extra time to the processing. While it is not outright required to submit a tax form for every business type in order for their Form 8802 to be processed, in some cases it is, so we tailored each different digital form flow to account for this.

See this example. The text in blue is a tooltip that alerts the filer that based on their response of “No” to the question “Was the applicant required to file a U.S. tax form for the tax period(s) on which certification will be based?“ that they are required to submit a tax form even though they have not already: “Based on your filing type (S Corporation), a tax form is required to submit Form 8802. However, you are still able to proceed with your application. Form 8802 applications submitted without a tax form can be delayed or take longer to process.” We workshopped this language carefully with the U.S. Certs team to make sure it was not prohibitive, and that it clearly stated that not having a submitted tax form did not preclude them from proceeding with their application. Preventing filers from proceeding with the digital form not only wasn’t necessary from the IRS perspective, but also would have led to a drop-off in form completion.

Parent/Parent Organization/Owner

We moved the Parent/Parent Organization/Owner questions into a section we labeled Tax Information which included tax form filing and Foreign Earned Income (covered after this). These questions are all covered in Form 8802, but spread throughout the form. We thought it made more sense to bundle these questions together, and after speaking with the U.S. Certs SMEs, it made sense to specifically move the Parent/Parent Organization/Owner questions before the Applicant Information because especially for the business flow, this information was more important than the Applicant Information for many business types.

This screen shows an example of an embedded instruction from the Form 8802 instructions that are already IRS.gov. This relates specifically to this part of the form and it is a slightly complicated part of the form where the U.S. Certs team pointed out filers have had trouble, so an easy way for filers to access guidance can be helpful.

Foreign Earned Income

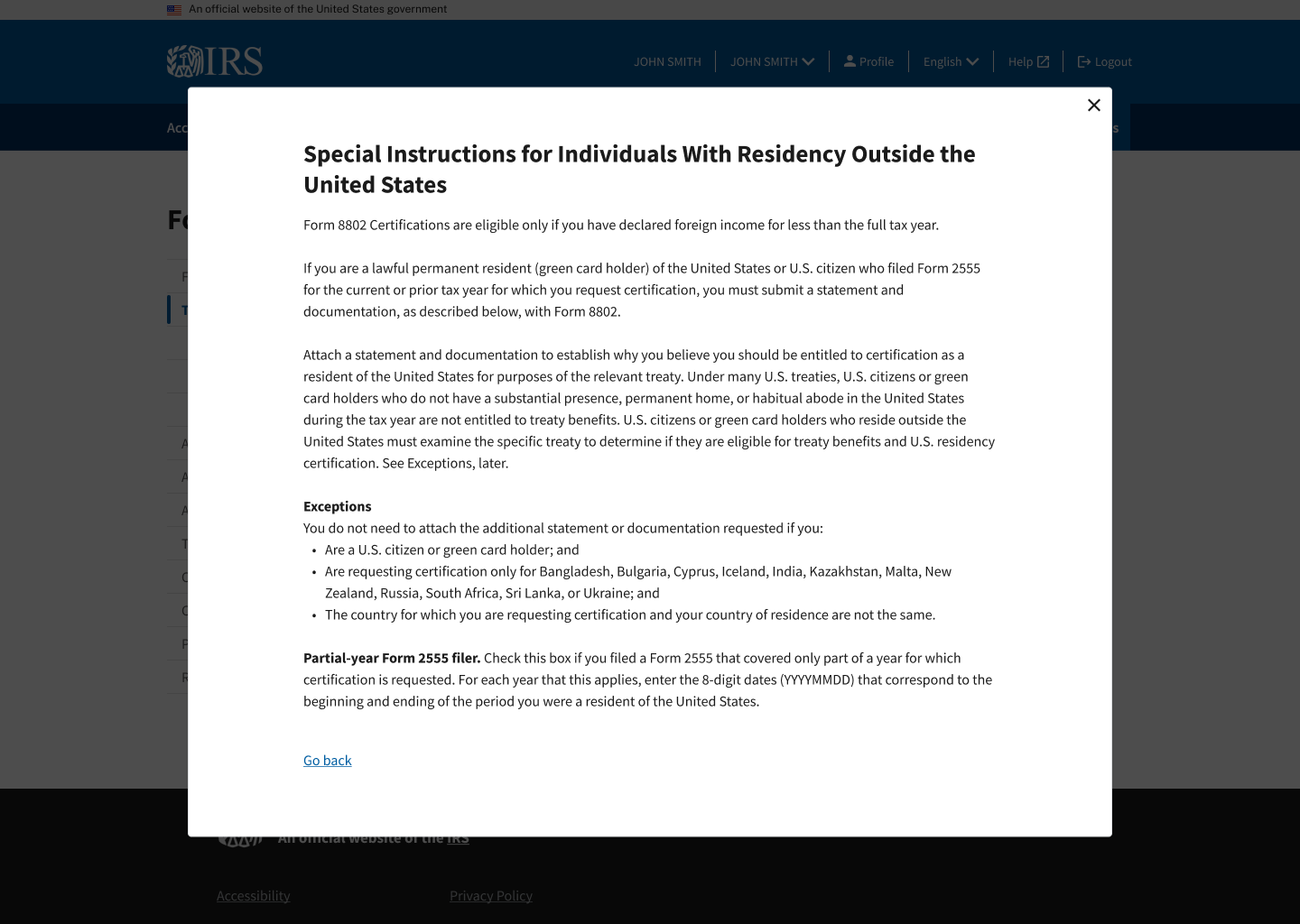

This question is only a small part of question 4a on Form 8802, and is complicated in how it impacts what filers need to do. These flows explain to filers what is expected of them based on how much foreign income they filed for.

Country Certificates

There were several ways this was prototyped—a few earlier versions besides the one pictured here appear in the clickable prototype. I worked with one of our engineers to figured out what ways would not only be feasible but the fastest for filers to add multiple countries while searching through lists of countries. The U.S. Certs team mentioned that there are several countries that are very commonly occurring in filings, so we suggested placing those at the top of a dropdown menu. Due to other priorities shifting, we didn’t complete an updated prototype of these pages before our contract was terminated, but this reflects a more “final” design for this part of the form.

For comparison, this is the country certificate part of the physical Form 8802.

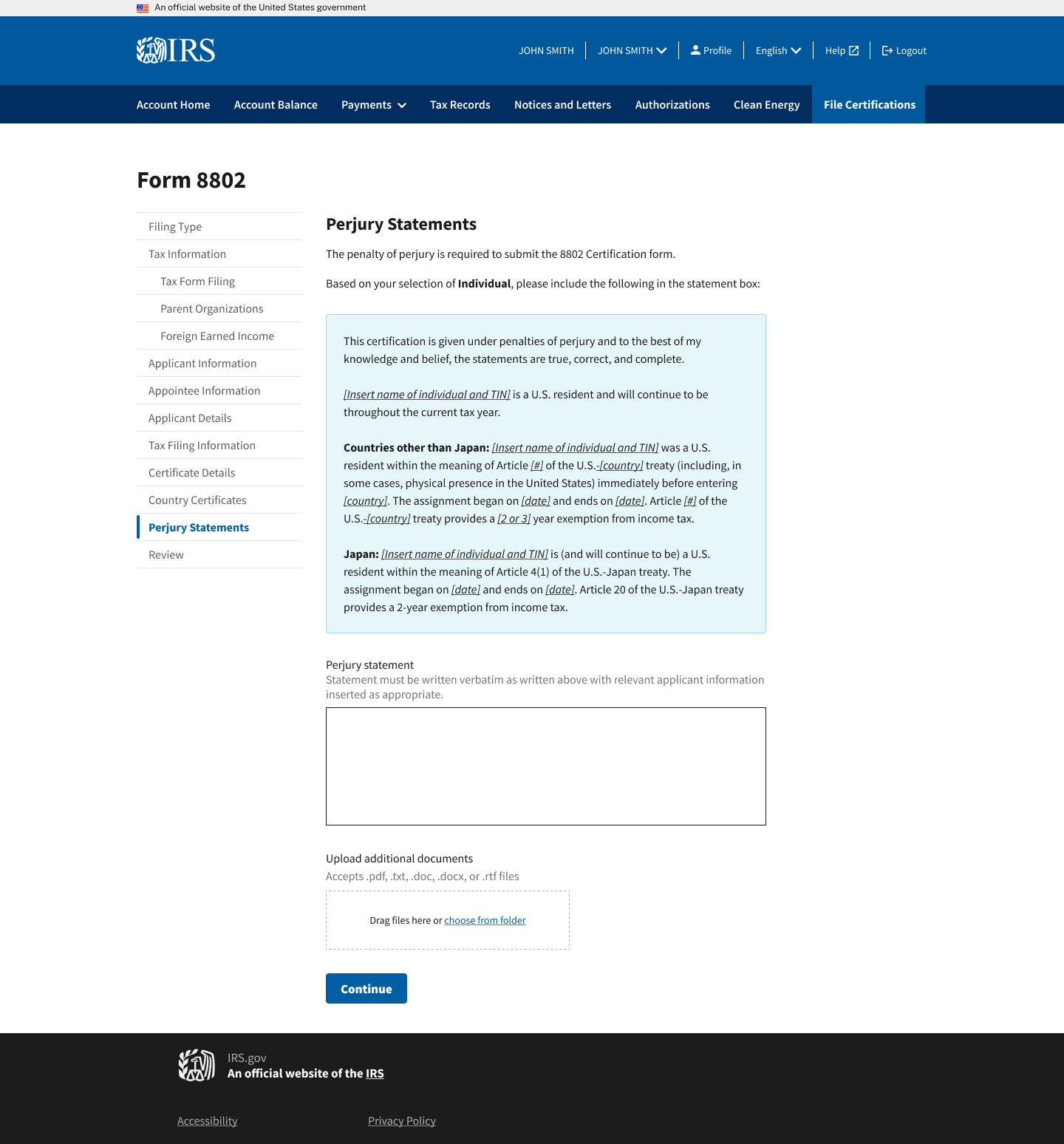

Perjury Statements

Final Form Review

Three of the 16-page separate instruction document for Form 8802 covers how to write penalties of perjury statements. Filers have to reference these lengthy instructions to accurately fill out this part of the form, and the changes we made to the digital form significantly simplify this.

Since the digital form puts filers on a track from the first question (individual or business, and then for business, business sub-type) the form the filer is filling out is tailored specifically to their filing type. This is no different for the perjury statements. In the blue box, the correct penalties of perjury statement is written for the filer to copy verbatim and enter their respective information. There is also a designated button for uploading supplemental documentation.

This allows the filer to review everything they’ve filled out, make any edits to a section, and sign the form digitally.

Reflections 🧠

Working at organizations as large and complex as the IRS means that even working on design challenges at a small scale will move at a slower pace than a project outside of the government space. It also means working with stakeholders who are less familiar with technology, design thinking, and moving at quicker paces, so meeting them where they’re at is essential. This project was more research focused than anything for these reasons—to build trust with our partners to ensure the solution we deliver is truly the most efficient for both them and the people they serve.